In today fast paced world, we all want to advance and earn enough money to pursue our aspirations. And, in some way, we all comprehend the level of freedom that comes with doing business. However, starting a firm is not a simple undertaking because it takes a significant amount of financial backing. And when it comes to money, not even banks gave financial assistance without the client providing collateral. To address this, some groups have taken a firm stance. Today, we’ll talk about a similar effort called SMPL, which attempts to provide financial assistance to folks who don’t have any collateral. Therefore, if you would also like to use this platform to get help, you must finish the SMPL Login process. We have provided some easy steps to help you through this process in this article.

Know About SMPL

Svasti Microfinance Private Limited, commonly abbreviated as SMPL, has taken a major push to give financial assistance to persons who lack collateral. The intuitive’s objective is to offer enough financial support for women, who are not only crucial members of households but also contribute to the national economy. This platform’s goods are specifically developed for women who wish to establish small enterprises or expand their existing businesses while living a meaningful life. Furthermore, the platform’s strong aim to accomplish a milestone of 10 million happy women and families distinguishes it as a unique platform in its own right.

Features of the SMPL Login

Once you have completed your SMPL Login, consumers will have a fantastic experience thanks to the upgraded and unique features of this microfinance organization. Here are some of the platform’s distinguishing qualities.

- Process Control: Unlike traditional methods, the platform works diligently to monitor and control all types of risk linked with its clients. The organization has around 500 CRMs and 2,000,000 clients, so it knows the need of process management.

- Resource Optimization: The platform is extremely successful at managing resources such as personnel efficiency, expenses, and data acquired by the firm.

- Data Analytics: With excellent data analytics, the platform can understand its clients’ segments, costs, and so on, allowing it to handle their demands more efficiently.

Process to Join Svasti SMPL Portal

Our research suggests that SMPL employs an offline registration strategy. Those who are in need of support from this organization can go to the nodal office of the corporation. The contact part of www.svasti.in has all the precise information on the office’s location.

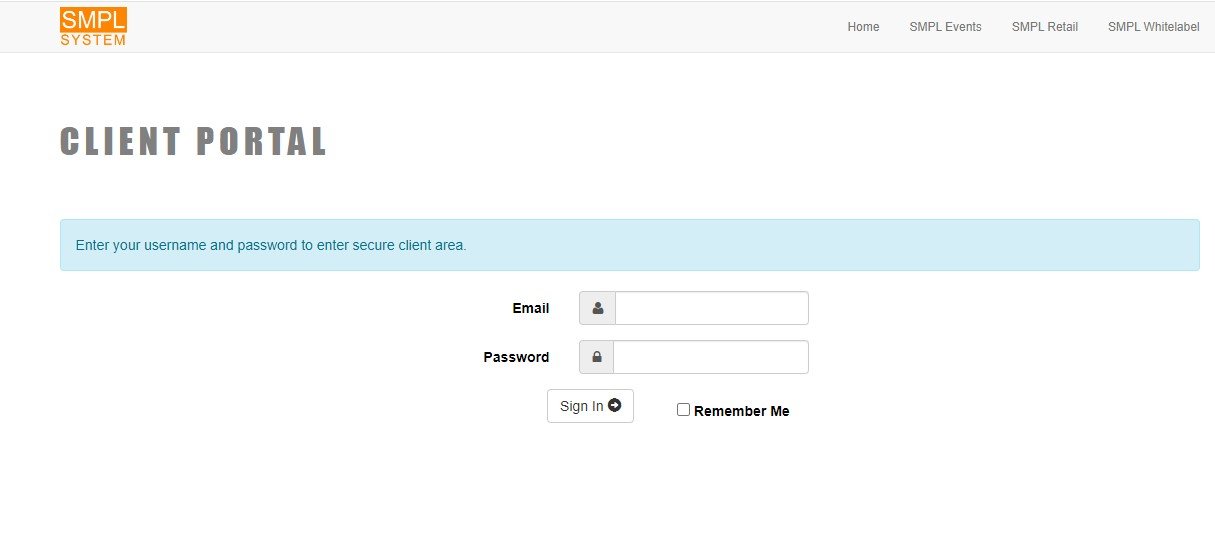

Process to Login Into The SMPL Portal

You should have received your username and password from the admin office after visiting the office’s closest branch and creating your account. It is essential that you store the information securely for your upcoming login.

- First, turn on your personal device and open your selected browser.

- Now use your browser’s search bar to find the SMPL Login.

- You will now be on the login page’s main dashboard as soon as you tap the highest-ranked result from the list of results.

- You will see two inputs on the login screen where you must enter the requested credentials.

- You must enter your username in the first input box and your password in the second.

- After entering the necessary information, double-check it to ensure a smooth login into your account, and then click “Login” to finish the SMPL Login process.

Various Products Provided by SMPL Login

After completing the SMPL Login successfully, clients are shown a wide range of product categories from which they can choose. Here, we’ve hardly even touched the surface.

- Microfinance: Women are the primary recipients of these loans, which help them launch and expand their companies. These loans place more of an emphasis on trust than on paperwork. There are products in this category that range from Rs. 20,000 to Rs. 80,000.

- Consumer Finance: The word “consumer finance” refers to short-term EMI repayment alternatives given to clients. These can be used to pay for necessities like prescription drugs.

- MSME Loans: The platform, which stands for Micro, Small, and Medium Enterprise, was created in response to the demands and aspirations of the general public about business. They provide loans under this that range from one lakh to five lakhs.

Benefits of Using SMPL Login

Once you sign in to the smpl login company and start using its services, you may enjoy a plethora of benefits. These are only a handful of the numerous benefits of this platform.

- Check-in Real Time: To ensure a smooth experience, users have access to a verified and automated digital KYC option that allows them to check in in real time.

- Planning and Supervision: The organization also automatically arranges the calendar based on personnel actions, events, and other factors.

- Branch Management: Among many other things, the platform handles transaction accounting, cash flow, paperwork, and branch management efficiently.

- Payment Procedure: The business offers customer service by providing phone support, which enables it to support and aid its clients in times of need.

- Gathering and Communication: Primarily, the platform manages all of its timetables and reports in an incredibly efficient way to provide a trouble-free experience.

Conclusion

To sum up, we can say that SMPL is a fantastic program designed to assist women in launching their ideal companies. Through the completion of the SMPL Login, customers may get loans that are not contingent on collateral of any type, enabling them to dream large and worry-free. In order to easily contact this firm, those who wish to take advantage of this effort can visit this platform and read this blog. So don’t hesitate any longer, release your goals, reach new heights, and transform your life for the better with the help of a solid business strategy and assistance.

READ MORE BLOG: Ilizone